The Rise of Prop Trading Companies in the Modern Business Landscape

In the fast-paced world of finance, prop trading companies have emerged as significant players in the market. They provide unique opportunities for traders, allowing them to operate with capital that is not their own while keeping a share of the profits. The evolution of trading and investment strategies has paved the way for this new breed of financial services, leveraging technology, data analytics, and specialized knowledge to thrive in a competitive environment.

Understanding Prop Trading Firms

Proprietary trading, often referred to as prop trading, involves financial firms trading financial instruments, including stocks, bonds, currencies, and derivatives, using their own capital. This type of trading is distinct from traditional investment firms that manage client assets. The goal of a prop trading company is to generate profits through trading, employing various strategies and tools.

How Prop Trading Works

At the heart of a prop trading company lies the concept of risk and reward. Here’s a breakdown of how these firms operate:

- Capital Allocation: Prop trading companies provide capital for traders to use in their transactions. Traders are not required to use their personal funds, which significantly reduces personal financial risk.

- Profit Sharing: Traders typically earn a percentage of the profits they generate, incentivizing them to maximize trading performance.

- Advanced Technology: These firms invest in sophisticated trading platforms and tools to enhance trading efficiency and decision-making.

- Training and Support: Many prop trading firms offer training programs and mentorship to bolster traders' skills and market understanding.

Benefits of Joining a Prop Trading Company

For many traders, joining a prop trading company offers several advantages over independent trading or traditional employment at a financial institution:

1. Access to Capital

One of the biggest hurdles for aspiring traders is access to sufficient capital. By joining a prop trading firm, traders can leverage the firm's capital to engage in larger trades that could yield bigger returns.

2. Reduced Risk

Traders in prop firms use the firm's money rather than their own. This arrangement allows them to experiment with different trading strategies without the fear of losing their personal savings.

3. Performance-Based Earnings

The compensation model in prop trading companies aligns the interests of the firm and the traders. As traders excel, they stand to earn more, fostering a culture of excellence and innovation.

4. A Collaborative Environment

Working alongside other skilled traders provides opportunities for collaboration, learning, and sharing insights, which can enhance individual trading performance.

5. Continuous Learning

Many prop trading firms provide ongoing education and training resources, helping traders stay abreast of market trends and trading techniques.

Challenges Faced by Prop Trading Firms

While the benefits are significant, prop trading companies also face unique challenges:

1. Market Volatility

Market unpredictability can lead to substantial losses for traders and, consequently, for the firm. Prop trading firms must implement robust risk management strategies to mitigate these risks.

2. Regulatory Compliance

Prop trading companies must navigate an intricate landscape of regulatory requirements to ensure compliance, which can be costly and time-consuming.

3. Technology Costs

As technology is crucial in prop trading, firms must continue to invest in the latest trading systems and tools to maintain a competitive edge, which can strain financial resources.

Strategic Approaches for Success in Prop Trading

Success in a prop trading company requires a strategic approach. Here are several essential strategies that traders might employ:

1. Develop a Trading Plan

A meticulously crafted trading plan is critical. This plan should define a trader’s risk tolerance, profit targets, and the methods for analyzing trades.

2. Focus on Discipline

Trading can be emotional, but maintaining discipline is key. Successful traders follow their plans and avoid impulsive decisions based on market fluctuations or emotions.

3. Use Advanced Analytical Tools

Leveraging data analytics and advanced trading tools can provide valuable insights into market trends, allowing traders to make informed decisions.

4. Stay Informed

Remaining up-to-date with financial news, economic indicators, and global events is crucial. Knowledge directly influences trading outcomes.

5. Experiment with Different Strategies

Traders should be open to experimenting with various trading strategies. This flexibility may lead to the discovery of unique approaches with high-profit potential.

Future Trends in Prop Trading

The landscape of prop trading is continually evolving, and several emerging trends could shape its future:

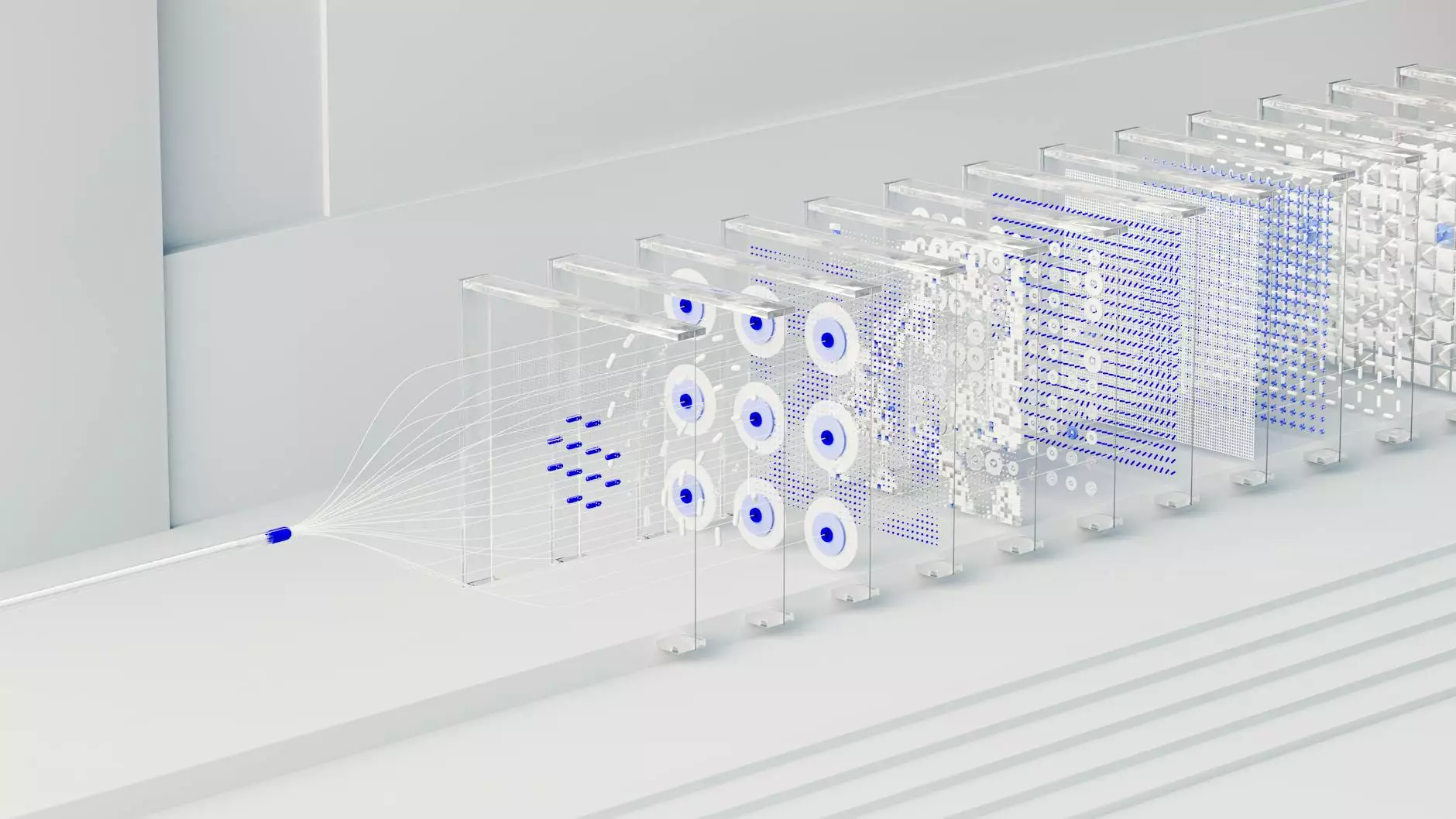

1. Increased Use of Artificial Intelligence

Artificial Intelligence (AI) and machine learning algorithms are set to revolutionize trading strategies. These technologies can analyze vast amounts of data, identifying patterns that humans may overlook.

2. Regulatory Changes

As the financial market evolves, regulatory bodies will likely implement new rules affecting prop trading firms. Staying compliant will be crucial for firms’ longevity.

3. Global Expansion

With globalization, prop trading firms may expand their operations internationally, seeking new markets and opportunities for growth.

4. Rise of Retail Traders

The increasing accessibility of trading platforms has led to the rise of retail traders. Prop trading firms may look to integrate these traders into their models, spinning them into potential partners.

Conclusion: Embracing Opportunities in Prop Trading

In conclusion, prop trading companies are vital forces within the financial services industry, offering innovative ways for traders to engage in markets. Their unique model of using proprietary capital allows for reduced financial risk and the potential for significant earnings. However, those who wish to succeed in this field must navigate various challenges and remain adaptable to an ever-changing landscape.

As we look to the future, embracing technology, regulatory compliance, and a focus on continuous learning will be essential for establishing a solid foundation in prop trading. For both aspiring and experienced traders, the opportunities presented by prop trading firms could be the key to unlocking their potential in the dynamic world of finance.